Welcome back to "Good Fellas Way." In my previous update a month ago, I mentioned that interest rates would remain high throughout 2024. I stated that for any chance of easing interest rates, we would need to see inflation drop below 3% and the unemployment rate enter the 5% range. Additionally, I assigned a 20% probability to the possibility of rising interest rates.

However, recent data has taken a decisively hawkish turn, indicating a likelihood of higher rates. The unemployment rate has decreased to 4.0% from 4.2%, and inflation has risen to an annual rate of 4.0% from 3.6%. That is four straight months of higher inflation. Regrettably, this shifts the probability of an interest rate hike as early as August.

This time, the blame falls on education costs, and despite a slowdown, rent costs are still 2.6% higher. Anecdotally, the economy seems weak, yet the data does not suggest a slowdown. It's interesting to observe the share price movements upon the initial inflation report; prices drop, then traders reassess, speculating that the forthcoming rate hike will be the tipping point, prompting the RBA to cut rates, leading to a sharp rally fuelled by the hope of interest rate reductions.

Although I expect some slowing in price increases, it probably won't be enough to alter the course of interest rates significantly.

Round and round we go!

So, in Australia and the USA, the data supports a higher and longer interest rate cycle. But looking elsewhere across the globe, there are signs of economic weakness emerging globally, particularly in Asian and European economies. Sweden, Switzerland, Europe, and Canada have all cut rates in the last month or so.

I like to keep a watch on global credit spreads for any early leads on market downturns. Analysing the credit spreads of government and corporate bonds can provide insights into a country's economic health. Recently, credit spreads in Europe have widened, indicating that markets are accounting for increased risk. This trend, still in its early stages, deserves close monitoring. It started with a political shift to the right in local French elections, which upset President Emmanuel Macron, leading him to call for a snap election.

The question arises: could this be akin to another Brexit event, and what would be the consequences of a hard-right victory?

Regarding Asia, our most significant trading partners, it was particularly noteworthy this past week that the currencies of Japan and China continue to depreciate, with Japan reaching record lows.

So what! Well, while history may never repeat itself, it can certainly rhyme. This situation is reminiscent of the Asian crisis of 1997, which started with the devaluation of the Thai Baht and quickly spread across Asia. At its peak, stock markets dropped by up to 70%, sending economies into a deep recession for two years. Notably, Norinchukin Bank, a Japanese bank, sold $63 billion of its U.S. Bonds at a significant loss to strengthen its balance sheet, possibly signalling deeper issues in Asia. The loss is attributed to the shift in yields of U.S. treasuries rather than the currency, as currencies are typically hedged.

However, it's important to remember that hedging is never entirely 100% effective, so some losses from this currency hedge are likely. Monitoring for potential contagion effects in the banking sector is crucial. On a brighter note, if you're considering a trip to Japan, now is an excellent time for a value-packed vacation. Having visited several times, I can confirm it's a fantastic country with efficient bullet train travel and exquisite cuisine.

Enough of the global macro events. Let’s take a look at local property and the business case for investing in property. I've been observing and contemplating the trends in house prices across Australia, especially since I've sold and bought properties and am looking to assist our children with their first home purchase. The more I examine the prices paid, the more I question whether property remains the golden goose it has been over the past 50 years.

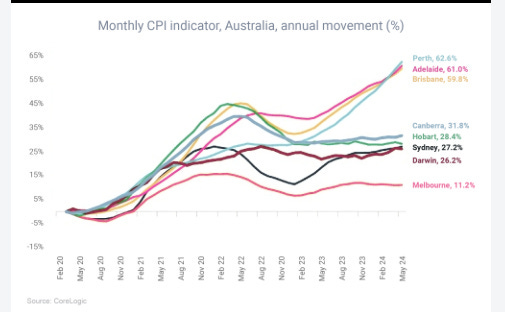

Regardless of whom I speak with, there seems to be an ingrained expectation that property will continue to perform as it always has. The conventional wisdom has been that property prices double every 10 years, and during growth cycles with low interest rates, this can occur as quickly as every 7 years. Or a super accelerated growth in like COVID, look at the chart below on house price increases from Feb 2020 (courtesy of core logic). However, let's take a closer look at the current situation and where to go next.

Given the combined median house prices in Sydney and Melbourne at $1.15 million, and considering these cities rank in the top 10 globally for the most expensive property, the investment thesis may be questionable. To purchase a property, one would need a $230,000 deposit plus an additional $50,000 for stamp duty.

However, with the median wage at approximately $75,000 per year, or $150,000 for a couple, the post-tax amount is around $104,000. Assuming you're renting and can save half of your net income—without having children—it poses a six-year saving challenge. Yet, with property prices historically compounding at 6%, a house initially worth $1.15 million escalates to $1.6 million, leaving you $100,000 short on the deposit, thus rendering the purchase unattainable.

This isn't applicable to everyone, and although there is the 'bank of mum and dad', the average inheritance is $125,000, usually not bequeathed until one reaches 50. Thus, the notion that the property wealth held by Baby Boomers and Generation X will sustain the next three generations appears quite unlikely.

Where, then, lies the long-term demand for property if younger generations are priced out of the market? The older generations reside in their large homes while the federal government initiates a cycle of reduced immigration and a significant stimulus to construct more houses and apartments. So, we are going to have more supply, particularly in units so maybe we need to consider an annual compound rate that aligns with the wage growth of 3%. If so, then in 10 years, your property may only increase in value by 40% over what you paid for it.

As this is an investment newsletter, I present an argument as to why investment property, particularly the unit market, does not stack up, and this confirms my post last year, where I wrote an article asserting that apartment investment property simply does not add up, which I have included again here. Now let me qualify, an investment in real land is preferred over a unit market and if you can identify growth in regional or coastal towns, you will, in my view, significantly outperform metro city apartment investments.

But if you look at the numbers on investing in residential property, it’s hardly compelling. The average rent yield is 2.87% the average investment property mortgage rate is 6.0%. The loss here is circa 3.0% per annum. OK, then claim the negative gearing. We bring that down to a net loss of 1.5%. Deduct this from your growth yield of 5.0%, and your real return is now 3.5%, and then this would take 20 years to double. It’s a change of mindset I am asking you to consider around residential property investment.

I always find time for crypto review here in my post, We continue to hold our cryptocurrency assets, I use fund manager Apollo Capital, and then I have a direct holding in Bitcoin (70%) and Ethereum (30%), representing an overall weight of 5–10% of my total portfolio. When looking at Bitcoin, the market appears to be chopping between 50k and 70k, and it seems unrealistic to expect profits in such an environment. On investment thesis, it's clear to me that altcoins, meaning everything else other than Bitcoin, Ethereum, and perhaps Solana, are not worth investing in. If you're holding or trading Altcoins, or 'Shitcoins' as they're referred to on Fin Twitt, it's time to stop and reassess your strategy.

On broader asset allocation, I remain with 10% listed property exposure, and we have increased our exposure to credit to 30%, while shares remain at a weighting of 50%. We have a very concentrated investment in Imricor Medical Systems. You may recall that this is my single largest holding and while price performance is not doing too well, the work on the ground is gathering pace and some recent announcements are very positive. I hope you all have a stake in this company, as it’s just a matter of time before we see higher prices. The other speculative investment, Dubber Corporation, is experiencing tax loss selling as June 30 approaches.

The pivotal factor for this stock is the annual report; if it shows that customers have stayed loyal despite the early-year incident where $25 million was embezzled by the CEO and an external lawyer, then the share price should recover.

If you like my posts and you think someone else would be interested in or benefit from them, then please share my Substack link here: The Good Fellas Link

Disclaimer

This information is of a general nature only and has been provided without taking account of your objectives, financial situation, or needs. Because of this, you should consider whether the information is appropriate in light of your particular objectives, financial situation, and needs.

Share this post