Photo credit: Bloomberg

It’s obvious that the older you get, the more you hear from the younger generation. I’ve been particularly interested in their views on the economy. While it doesn’t surprise me, most, if not all, don’t see the storm clouds in the economy or have no opinion at all. It makes sense as most were in their early 20s when we had our last recession in 2008, and they were at school and wouldn't recall the tech wreck of 2001 and forget about the 1990-91 recession that saw Westpac Bank verge on bankruptcy. Many were not yet even at school.

For those who are interested, I keep hearing from this cohort “when interest rates fall.” This cohort, which holds the greatest debt of the current population, is missing any historical perspective.

If you look at Australia, the average home mortgage rate from 1970 to 2023 was 6.87%, so at current rates of 6.5%, we are just at the long-term average. However, how long can this cohort carry this normalised interest rate?

Investors are the early sellers, and sadly, it's the owner occupiers that will be forced sellers next, with average mortgage repayments now up 60% from 2021, and at an average loan of $750k, repayments are now $4760 vs. $3160 in 2021. Something is breaking here in housing. Take a look at the growth in arrears over the past 30 days in the chart below. (The Courtesy of the Avid Commentator shows the growth in 30-day arrears for mortgages.)

As an accountant to a significant number of businesses in the real estate sector, there is indeed an increase in sales with listings compared to this time last year. So there is some antidotal evidence, but not yet enough to call it a recession yet. But we look vulnerable.

So this middle-income cohort is also the same cohort that drives economic growth, so with last week’s latest rate rise by the RBA and possibly yet another one in December or February on the back of sticky inflation, low unemployment, and growing wages (latest report +4.1% highest in 15 years).

The problem, as I see it, for this co-hort is the expectation of lower interest rates and that they can hang on until that eventuates. While I'm calling it a recession, this isn't likely a GFC style, more like 2001, let's say mildly. A mild recession is the worst outcome, as it prolongs the pain and reduces the chance of sharp, large interest rate cuts, which is what this co-hort is desperately hoping for. In case you don’t know, we call this "hopium,” and it’s not a strategy. The hope is that interest rates will return to 2-3%. That just won't occur. Get set for normalised borrowing rates in the 4-5% range, and sadly, that still hurts.

I am suggesting all clients position themselves for this incoming recession, and how you do this is to take yourself NOW to the worst possible outcome and have your plan in place NOW on how to cover this event. Some metrics you might want to consider are: business revenue is down 30–50%; if employed, consider what happens if unemployed; and how long will your funds last?

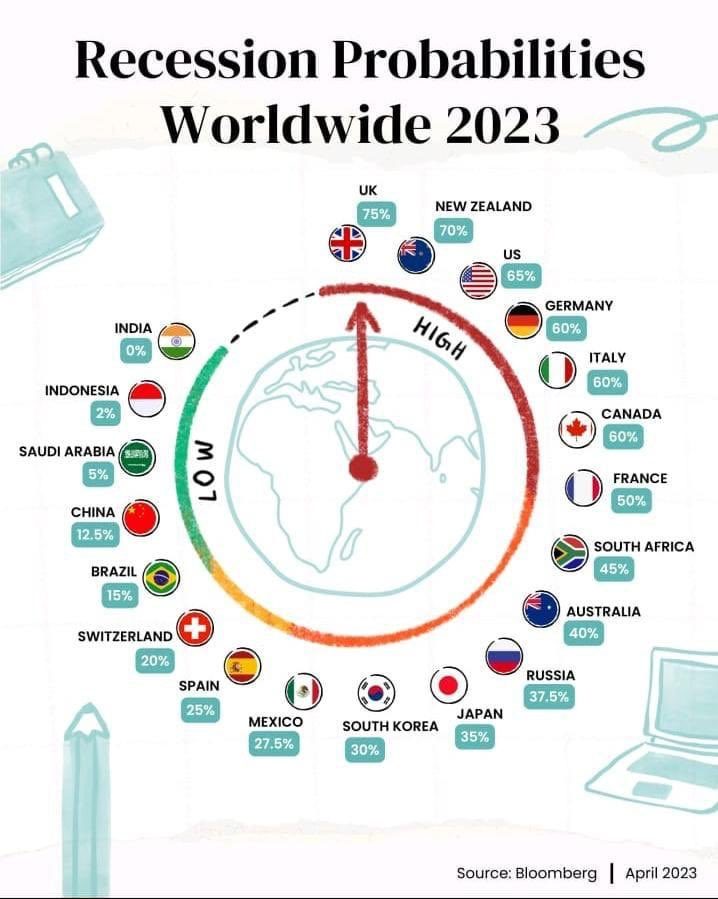

Don’t think this is isolated to Australia. China is just going from bad to worse as they unwind the irrational exuberance of their property market from 2015 to 2021. In Europe, manufacturing numbers point to the lowest since the GFC of 2008, and in the US, while it seems to be traveling better than the rest, there are early signs of an incoming recession with credit card defaults and bankruptcies at levels not seen since the GFC. The broader economy, though, continues to print growth, with September Qtr GDP annualised growth of 4.9%, but this is primarily being held up with its fiscal stimulus, now known as "Bidonomics,” a policy of spending, spending, and spending. But there is one very big problem in the US that is still yet to play out, and it’s the 33 trillion in federal government debt that somehow needs to be funded. In my view, the USD has to go lower if they hope to sell the enormous debt to investors. So long bonds are not going back to sub-3% any time soon.

Remember, these were at 0.5% in 2021? If you want some further evidence of the real economy in the USA, look at the performance of the majority of listed small-cap shares. The Russell 2000 is down 15% in the last 4 months and 30% from its peak. Move to the S&P 500, and 64% of all companies are down more than 20% within the last year. This is the real economy, not the magnificent 7 of S&P.

So let’s be clear: I do believe we are in an early global recession, but how deep or shallow this is is just a guess. Back home here in Australia, the legislated tax cuts in 2019 start to come into effect on July 1, 2024, so this will also cushion the severity of the recession. But it’s also very inflationary. But don’t be ignorant of what a recession means; it lowers revenue for businesses and causes job losses.

If you are fortunate enough that your debt is at a lower percentile, then these next 3–6 months can be the greatest opportunity to build your wealth. There is a saying I recite often: “You make your money when you buy.” You will see opportunities in all asset classes, particularly equities, and delayed opportunities in property. You will also want to look at commodities and energy, which are fast becoming their own asset classes.

If you are retired or close to retiring, there is no time to wait. Now is the time to buy fixed-income bonds. In my view, we are somewhere close, maybe within 10% of the peak. A Westpac Bank 10-year investment-grade bond at 7.2% looked compelling.

There are always investment opportunities; it’s just about what you allocate and how much. I have been writing here for some time that we will see some good opportunities if a recession plays out, so stay interested and have some powder dry.

Moving to crypto, if you watch the bitcoin price, it is on the march higher, and this is now in a clear bull market. Note that bull markets grind higher, unlike bear markets that have significant short-covering rallies like last week's S&P 500 one-day move of +4%.

Bitcoin and Ethereum have some significant tailwinds over the next 6–12 months. Bitcoin will halve in April 2024, meaning the mining of bitcoin will halve in value. This historically has supported the price and is an anti-inflationary adjustment. Historically, price action has mostly been higher.

See below for the actual stats:

2012, the first halving up +153% after 3 months

2016, after 3 months, down -2.2%

2020, after 3 months, up 36%

But the other big event happening for the two heavyweights in crypto is that Bitcoin and now Ethereum are likely to get access to the mainstream with a listing via the US Securities Exchange approving various ETFs. This is a very significant position, as it simplifies how you can access this asset class. I am predicting we will see new all-time highs in Bitcoin in 2024. I have been a supporter of this asset class for many years, and I have an allocation to Bitcoin and Ethereum and a crypto fund, Apollo Capital. I have suggested a 5% allocation as prudent and taken a 10-year view. If you don’t own any, you may want to consider layering your exposure to this asset class over time.

Being in the investment industry for more than 30 years, I see a lot of opportunities, and if I am honest, most go through the keeper. But I have been invested in this ASX share known as Imricor (IMR) for about a year, and yes, it has done pretty well. I have not sold a single share, and recently, I added to my holding substantially more via a private placement at 50c. Before doing so, I did a great deal more research on this company. I have met the CEO and CFO (both genuine and real people), and I have read through all the recent announcements.

I have also looked at the potential forward valuations, and they look very interesting, if not compelling. It is not for me to throw out big numbers and pump a share. I have a 5-year time horizon on this share that I believe will be multiples higher than where we are today. It is now my single kargey holding outside of property. I have provided a link to a presentation here for your own review. (5 minutes read), and if you would like to see the forecast valuations, get in contact, and I will be happy to share them with you.

Sticking with my shares, I have also allocated them to the listed property sector. We hold some industrial REITS, but we added Lend Lease at current levels of $6.60. We will need to be patient, but this has fallen 70% from highs, and the worst is likely priced in having made a double bottom at $6.10.

I have also allocated Whitehaven coal. The recent acquisition of BHP Metallurgical Coal at a very favourable price looks compelling to me, with far more diversity and an extended mine life of 50 years or more (i.e., bullish commodities and energy long-term).

As always, when investing, “you can only manage one thing: how much you risk." You should always be invested; it's just a matter of how much and what asset classes.

I missed the opportunity this time to share my next investment, which I think can grow 10x over the next 10 years. Stay tuned!

Share this post